If these criteria are not met, the worker is an independent contractor who is responsible for paying their own taxes.

When these three criteria are met, the IRS considers the worker an employee of your company, and you are responsible for filling out a W-2 and paying your share of the FICA taxes.

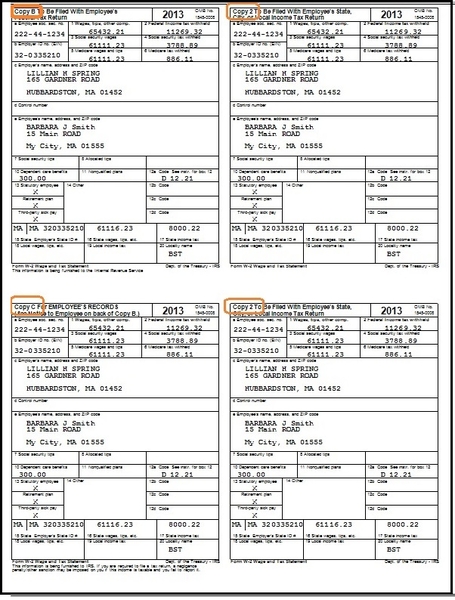

You don’t send a 1099-MISC to the plumber who installs your new bathroom. The IRS stipulates that a business is responsible for sending a 1099-MISC form when someone provides “rents, services (including parts and materials), prizes and awards, or other income payments.”īut “someone” is not just anyone. The following conditions must apply in order for you to need to send 1099-MISC forms out. It can be a bit confusing to know exactly when you need to send the form.

When Do You Need to Send a 1099-MISC Form to Service Providers? The 1099-MISC is also used to report royalties, prizes, and awards over $10. The 1099-MISC serves as an informational reminder of how much an independent contractor earned from each company they provided services for and gives them an official form to attach to their 1040 return, in lieu of the W-2. The IRS requires businesses to file a copy of the 1099 form with them and mail another copy directly to the independent contractor so that the IRS can predict how much tax revenue to expect from self-employed individuals. Companies use it to report income earned by people who work as independent contractors rather than regular payroll employees. 1099-MISC in a Nutshellįorm 1099-MISC is the most common type of 1099 form.

#1099 MISC FREE FORMS FOR 2016 TAX RETURNS PDF#

Using an online fillable form allows you to download information instantly and generate professional PDF forms in just a few minutes’ time.

#1099 MISC FREE FORMS FOR 2016 TAX RETURNS HOW TO#

Knowing when and how to report income you paid to an independent contractor can be tricky.īut order to protect your business in the event of an IRS audit, it’s important to generate timely and accurate 1099-MISC forms every year. And if you’re being honest, you may have been tempted to forego documenting that pay – even if you claim it as a deduction on your business taxes. You’ve probably hired your share of self-employed individuals. Create Flawless 1099-MISC Forms – Every Single Time It can also be used to report royalties, prizes, and award winnings. 1099-MISC is a variant of IRS Form 1099 used to report taxable income for individuals that are not directly employed by the business entity or individual making the payment. Create Your Version of This Document What is Form 1099-MISC?įorm 1099-MISC is the most common type of 1099 form.

0 kommentar(er)

0 kommentar(er)